Homeowner consolidation loans merge multiple debts into one with a lower interest rate, using property equity. This simplifies payments, saves money, and improves financial health. To apply, prepare detailed financial documents, understand terms & conditions, and compare offers from different lenders to get the best deal based on your specific situation, focusing on Homeowner Consolidation Loans.

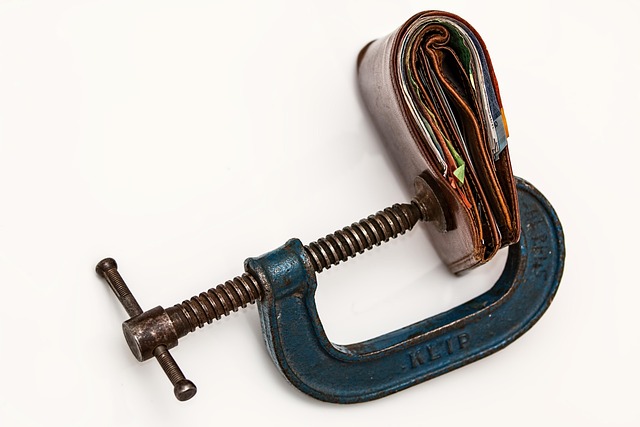

Struggling with multiple debts as a homeowner? Consider debt consolidation loans, a strategic approach to simplify repayment and potentially lower interest rates. This article guides you through the process, focusing on homeowner consolidation loans and navigating applications without a credit check. Understanding these options is crucial for making informed decisions about your financial future. Learn how to access funding while maintaining control over your finances.

- Understanding Debt Consolidation Loans for Homeowners

- Navigating No-Credit-Check Loan Applications Effectively

Understanding Debt Consolidation Loans for Homeowners

Debt consolidation loans for homeowners offer a practical solution for managing multiple debts by combining them into one single loan with a lower interest rate. This strategy allows property owners to simplify their financial obligations, making it easier to stay on top of their monthly payments and potentially save money in the long run. Homeowner consolidation loans are particularly appealing as they leverage the equity built up in the property, providing access to funds without the need for a strict credit check.

By consolidating debts, homeowners can say goodbye to multiple bills with varying interest rates, reducing the risk of missed payments and improving their overall financial health. This process streamlines repayment, making it more manageable and often results in significant savings on interest costs. Whether it’s credit card balances or existing loans, these consolidation loans offer a new beginning, enabling homeowners to regain control over their finances and secure a brighter financial future.

Navigating No-Credit-Check Loan Applications Effectively

Navigating no-credit-check loan applications for homeowner consolidation loans requires a strategic approach to ensure success. The absence of a credit check might seem like a green light, but lenders often compensate with rigorous scrutiny of other financial indicators. When applying, be prepared to provide detailed financial information such as income statements, bank statements, and proof of home ownership. This ensures that lenders can accurately assess your ability to repay the loan without relying solely on your credit score.

Additionally, understanding the terms and conditions is paramount. No-credit-check loans often come with higher interest rates and shorter repayment periods. Thoroughly review the agreement to avoid unexpected fees or penalties. It’s also beneficial to compare multiple offers from different lenders to find the most favorable terms tailored to your financial needs and situation.

For homeowners looking to consolidate debt, understanding no-credit-check loan options can be a game-changer. These loans offer an accessible route to financial management by skipping traditional credit assessments. By navigating these applications effectively, homeowners can secure funding for consolidation, simplifying their financial landscape and potentially saving on interest rates. Homeowner consolidation loans, with their no-credit-check approach, provide a viable solution for those seeking debt relief without the usual stringent requirements.