Homeowner Loans: Consolidate Debt Despite Low Credit Scores

Homeowner Consolidation Loans offer a strategic way for property owners with bad credit to manage mu…….

In the complex world of finance, homeowners often find themselves navigating a maze of loan options, especially when seeking to manage or improve their properties. This is where Homeowner Consolidation Loans step in as a powerful tool, offering a streamlined approach to financial obligations related to real estate. In this comprehensive guide, we will delve into the intricacies of these loans, exploring their purpose, benefits, and the global impact they have on both individuals and economies. By the end of this article, readers will have a thorough understanding of how consolidation loans can simplify homeownership and contribute to financial stability.

Homeowner Consolidation Loans, often referred to as Home Equity Loans or Line of Credit, are financial products designed to enable homeowners to pool their various loan obligations into a single, more manageable debt. These loans leverage the equity built up in a property—the difference between its current value and the outstanding mortgage balance—as collateral. The core components typically include:

The concept of consolidation loans has evolved over centuries, reflecting changes in financial markets and societal needs. Historically, homeowners used to rely on traditional bank loans for property purchases, with limited options for debt consolidation. However, the introduction of home equity loans in the late 20th century revolutionized personal finance, offering homeowners a way to access the growing equity in their properties.

These loans gained significant popularity due to their flexibility and potential benefits:

In the modern financial landscape, Homeowner Consolidation Loans play a crucial role in:

The reach of Homeowner Consolidation Loans extends far beyond national borders, with significant impacts observed worldwide:

| Region | Key Trends | Notable Influences |

|---|---|---|

| North America | High loan penetration rates, especially in the US, driven by a mature real estate market and favorable economic conditions. | The US Federal Reserve’s monetary policies have played a crucial role in shaping interest rates for these loans. |

| Europe | Diverse approaches, with some countries offering generous tax benefits for home equity loans, while others focus on regulatory frameworks. | The Eurozone crisis led to tighter lending standards, impacting the availability of consolidation loans. |

| Asia Pacific | Rapidly growing market, particularly in countries like China and Japan, due to increasing property ownership and a young population. | Local governments have implemented policies to encourage homeownership and support homeowners through loan consolidation. |

| Latin America | Rising popularity, with governments promoting access to credit for housing improvement. | The Inter-American Development Bank has initiated programs to enhance financial inclusion through home equity lending. |

Key trends shaping the global landscape include:

The Homeowner Consolidation Loan market is influenced by several economic factors:

At an individual level, consolidation loans can:

On a national scale, they can have both positive and negative effects:

Homeowner Consolidation Loans are often utilized for a variety of home improvement projects, including:

While these projects may enhance home comfort and value, it’s crucial to consider:

To protect borrowers and maintain market stability, many countries have implemented regulations for Homeowner Consolidation Loans:

Regulatory bodies play a vital role in:

The digital revolution has significantly impacted the Homeowner Consolidation Loan market:

The future of consolidation loans may include:

Homeowner Consolidation Loans provide homeowners with access to significant financial resources for various purposes. Whether it’s debt consolidation, home improvement, or emergency funds, these loans offer both advantages and considerations. With the ongoing digital transformation, borrowers have more options and convenience but must stay informed about potential risks and benefits. Understanding these aspects empowers homeowners to make wise decisions when considering a Homeowner Consolidation Loan.

Homeowner Consolidation Loans offer a strategic way for property owners with bad credit to manage mu…….

Homeowner Consolidation Loans streamline home improvement funding by bundling multiple high-interest…….

UK homeowners with bad credit can access lower interest rates and simplified debt management through…….

Homeowner Consolidation Loans streamline multiple debt payments, offering lower interest rates and r…….

Homeowner Consolidation Loans streamline debt management by combining multiple high-interest debts i…….

Homeowner Consolidation Loans streamline debt management by merging multiple debts into one lower-in…….

UK residents with bad credit can manage debt through homeowner consolidation loans secured against p…….

Homeowner consolidation loans merge multiple high-interest debts into a single lower-interest mortga…….

Homeowner consolidation loans combine multiple debts into a single repayment with potentially lower…….

Homeowner Consolidation Loans bundle multiple high-interest credit card debts into a single, lower-i…….

Homeowner consolidation loans streamline multiple mortgage payments into a single loan with potentia…….

Homeowner consolidation loans bundle multiple personal loans and credit card debts into a single loa…….

Homeowner consolidation loans simplify debt management by combining multiple loans into one fixed-ra…….

Homeowner Consolidation Loans provide a strategic solution for UK residents with bad credit to manag…….

Homeowner consolidation loans streamline debt management by combining multiple loans into one with p…….

Homeowner Consolidation Loans streamline home improvements by combining multiple debts into a single…….

Homeowner Consolidation Loans simplify debt management during a new home purchase by combining multi…….

Homeowner consolidation loans combine high-interest home debts into one loan with potentially lower…….

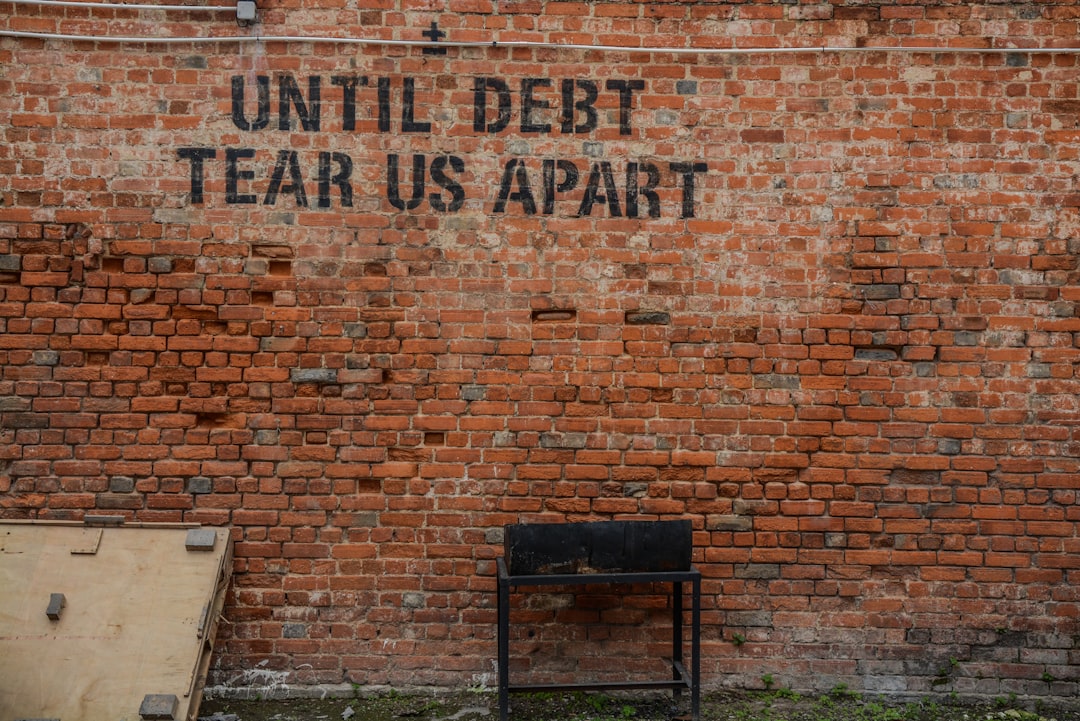

Unemployment and multiple debts create a cycle of missed payments. Homeowner Consolidation Loans mer…….

Homeowner consolidation loans merge multiple debts into a single mortgage-backed loan, reducing mont…….

Homeowner consolidation loans bundle high-interest debts into a single payment secured against your…….

Homeowner consolidation loans combine high-interest home-related debts into one lower-rate loan, sav…….

Homeowner Consolidation Loans streamline debt management and fund home improvements by combining mul…….

Homeowner Consolidation Loans streamline high-interest credit card debt by combining multiple balanc…….

Homeowner consolidation loans (HCLs) offer lower interest rates by using property as collateral, mer…….

Homeowner consolidation loans offer a strategic way to manage high-interest credit card debt by bund…….

Homeowner consolidation loans combine high-interest credit card debts into a single, lower-rate loan…….

Married couples with varying incomes can effectively manage debt through Homeowner Consolidation Loa…….

Homeowner Consolidation Loans differ as secured loans require collateral like real estate, offering…….

Homeowner Consolidation Loans streamline financial obligations during home purchases by merging high…….

Unemployment leads to financial strain and debt. Homeowner Consolidation Loans merge multiple debts…….

Homeowner Consolidation Loans combine multiple personal loans into a single, lower-interest repaymen…….

Homeowner consolidation loans combine multiple mortgage debts into a single loan with potentially lo…….

Homeowner consolidation loans are a popular solution for UK residents with bad credit histories, off…….

Homeowner consolidation loans, secured by home equity, offer a solution for individuals with less-th…….

Homeowner Consolidation Loans (also known as home equity loans) allow homeowners to borrow against t…….

Homeowner Consolidation Loans are a strategic solution for married couples overwhelmed by debt, simp…….

Homeowner Consolidation Loans simplify complex debt management by bundling multiple mortgage loans i…….

Married couples with differing incomes can ease debt burden through Homeowner Consolidation Loans, c…….

Homeowner consolidation loans streamline multiple high-interest debts into a single payment, offerin…….

Homeowner consolidation loans provide a popular solution for UK homeowners looking to simplify multi…….

Homeowner consolidation loans provide a strategic way to manage and reduce multiple high-interest de…….

Homeowner consolidation loans streamline new property purchases by merging multiple high-interest de…….

Homeowner consolidation loans streamline debt management by combining multiple high-interest propert…….

Homeowner consolidation loans are a popular solution for individuals buying new properties, combinin…….

Homeowner consolidation loans provide a strategic solution for managing multiple high-interest credi…….

Homeowner Consolidation Loans streamline debt management by bundling multiple high-interest debts in…….

Homeowner consolidation loans in the UK offer a strategic solution for managing multiple debts by co…….

Homeowner consolidation loans in the UK offer a powerful tool for managing and reducing debt, especi…….