Homeowner Consolidation Loans streamline multiple debts into one repayment, offering lower rates, simplified terms, and flexibility. Secured options (backed by home equity) provide competitive rates but require collateral, while unsecured loans offer greater access but higher interest. Combining both types can deliver personalized, manageable debt solutions for UK homeowners with substantial home equity.

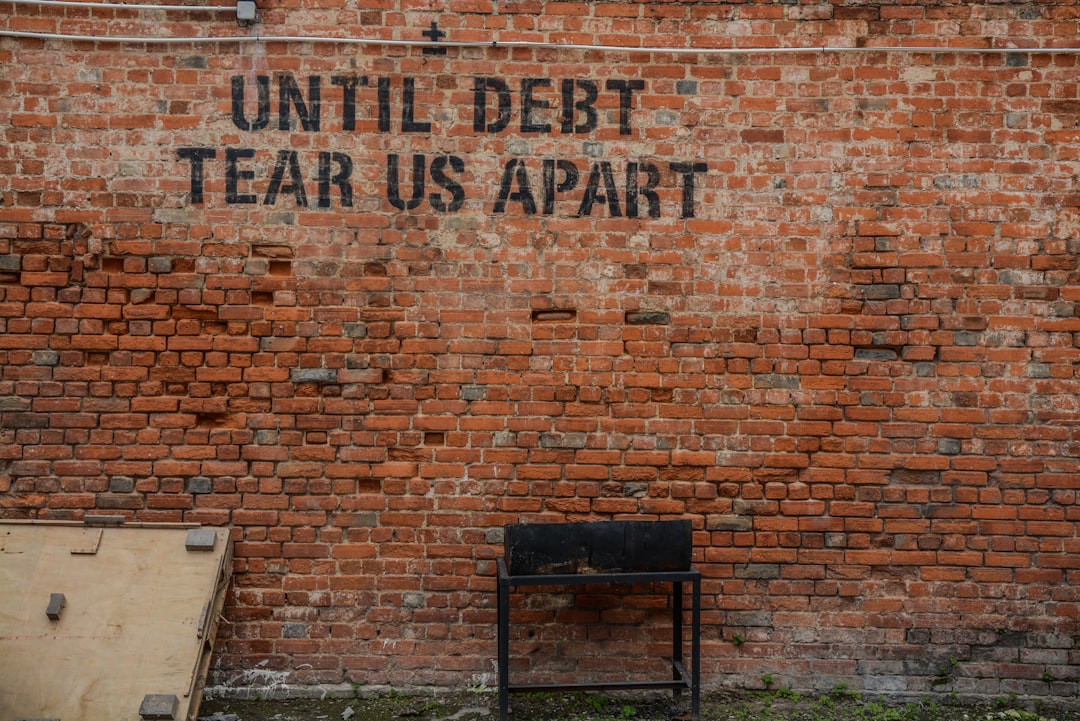

In the quest to overcome debt, Homeowner Consolidation Loans in the UK offer a strategic solution. This comprehensive guide explores how these loans can simplify financial burdens by combining multiple debts into one manageable repayment. We delve into the benefits and eligibility criteria for homeowner consolidation loans, comparing secured and unsecured options. Additionally, we uncover the advantages of blending loan types, providing customized solutions tailored to UK borrowers’ unique circumstances.

- Understanding Debt Consolidation Loans: A Comprehensive Overview

- Homeowner Consolidation Loans: Benefits and Eligibility Criteria

- Secured vs Unsecured Loans: Weighing the Pros and Cons

- Combining Loan Types: Customized Solutions for UK Borrowers

Understanding Debt Consolidation Loans: A Comprehensive Overview

Debt consolidation loans are a popular tool for homeowners in the UK looking to simplify their finances and manage their debt more effectively. These loans offer a chance to combine multiple debts into one, making repayment easier and often at a lower interest rate. Whether it’s credit card balances, personal loans, or store cards, a homeowner consolidation loan can streamline these payments.

When considering this option, homeowners should explore both secured and unsecured loans. A secured loan uses an asset, like a property, as collateral, potentially offering lower rates but with increased risk. Unsecured loans, on the other hand, don’t require collateral, making them riskier for lenders but providing greater flexibility to borrowers. Combining both types can sometimes provide the best of both worlds, offering competitive rates and manageable terms while keeping your home safe.

Homeowner Consolidation Loans: Benefits and Eligibility Criteria

Homeowner Consolidation Loans offer a powerful tool for managing debt, especially for those with substantial home equity. The primary benefit lies in their ability to simplify complex debt structures by combining multiple loans into one, often at lower interest rates. This not only reduces monthly payments but also streamlines repayment terms, making it easier for borrowers to get their finances back on track. For instance, homeowners dealing with credit card debt, personal loans, and even existing mortgages can consolidate these into a single, more manageable loan.

Eligibility for such loans largely depends on the value of the property and the borrower’s creditworthiness. Lenders typically require a significant amount of home equity, often expressed as a percentage of the property’s value. Good credit scores also play a vital role in securing favourable loan terms. Homeowner Consolidation Loans can be particularly attractive for those looking to escape high-interest debt or simplify their financial obligations.

Secured vs Unsecured Loans: Weighing the Pros and Cons

When considering debt consolidation loans in the UK, understanding the difference between secured and unsecured options is crucial for making an informed decision, especially if you’re a homeowner. Secured loans are backed by an asset, typically your home, which serves as collateral. This means lower interest rates but carries the risk of foreclosure if you default on payments. On the other hand, unsecured loans don’t require collateral, making them more accessible but usually come with higher interest rates and stricter borrowing limits.

For homeowners looking for a homeowner consolidation loan, secured options can be attractive due to potentially better terms. However, it’s essential to assess your financial situation and comfort level with the potential risk. Unsecured loans offer flexibility and no risk to your home but might require more stringent affordability checks. Weighing these pros and cons will help tailor the right debt consolidation strategy for your unique circumstances.

Combining Loan Types: Customized Solutions for UK Borrowers

In the UK, many borrowers are seeking personalized solutions for managing their debts, and combining secured and unsecured loans can offer just that. Homeowner consolidation loans provide a flexible approach, catering to a wide range of financial needs. This method allows individuals to bundle multiple debts into one manageable repayment, streamlining their finances. For homeowners with equity in their properties, a secured loan offers lower interest rates and longer repayment terms, making it an attractive option for debt consolidation.

By combining both secured and unsecured loans, borrowers can create a tailored plan. Unsecured loans are ideal for those without collateral but may require higher monthly payments. Secured loans, on the other hand, provide relief from strict repayment schedules, as they leverage home equity. This combination allows UK borrowers to choose a loan structure that aligns with their financial goals and circumstances, ensuring a more sustainable debt management strategy.

Debt consolidation loans offer a flexible path to financial freedom, with options tailored to suit UK borrowers’ diverse needs. Whether opting for secured or unsecured loans, or combining both, understanding these loan types empowers individuals to make informed decisions. For homeowners seeking relief from debt burdens, homeowner consolidation loans provide a powerful tool, offering benefits that can simplify repayment and reduce stress. By carefully weighing the pros and cons of each loan type and considering personalized solutions, UK borrowers can navigate their financial landscape with confidence and take control of their future.